FRM@China

-

- 0 Rating

- 0 Reviews

- 72 Students Enrolled

FRM@China

A novel systemic financial risk indicator in China

-

- 0 Rating

- 0 Reviews

- 72 Students Enrolled

Requirements

- none

General Overview

Description

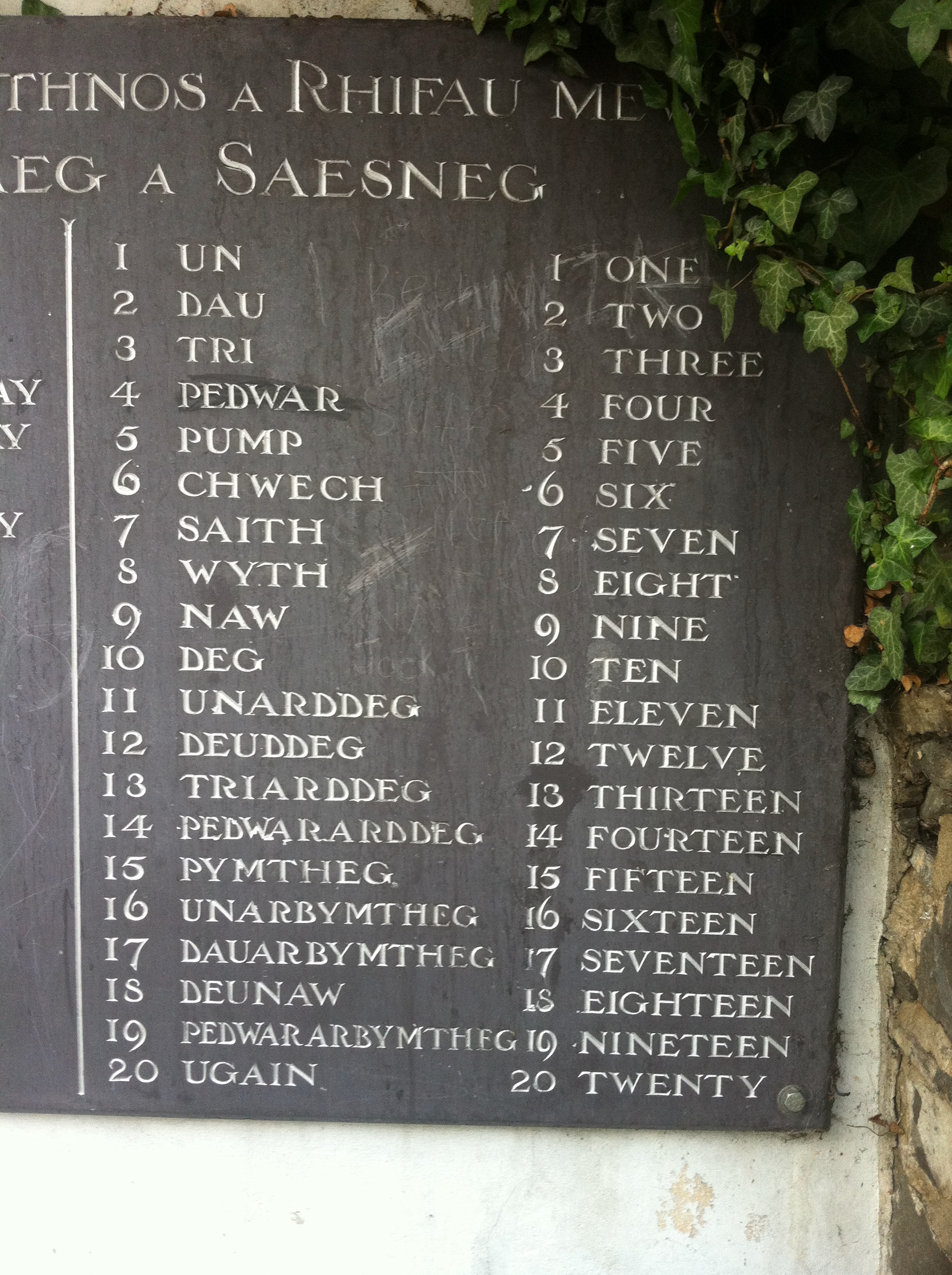

This paper develops a new risk measure (FRM@China) for China to detect systemic financial risk and tail event (TE) dependence among major financial institutions (FI). Compared to the CBOE FIX VIX, the most popular financial risk measure, FRM@China has less noise and emitted a risky signature much earlier than CBOE FIX VIX index in the 2020 COVID pandemic. Besides, FRM technology allows the inspection of the risk transfer between various sectors that those FIs operate in as well as the prediction of systemic risk in one quantile-lasso regression model. As the FRM index is based on the penalization terms, its relationship with macro variables is unknown and non-linear. This paper expands the existing FRM by using Shapley values to obtain the dynamic contribution of different macro features in such a "black box" situation. The results discovered that short-term interest rates and forward guidance are risk drivers. Taking into account the interaction between financial institutions in the Mainland, Hong Kong, and Taiwan, this paper provides a regional toolset for regulators to analyze financial policy responses.

Courses that include this CL

Recommended for you

Meet the instructors !

Phd in Sun Yat-sen University visiting Phd in Humboldt University of Berlin