Persistence in Economic Networks

-

- 4.3 Rating

- 1 Reviews

- 4 Students Enrolled

Persistence in Economic Networks

Networks, Big Data, Time Series

-

- 4.3 Rating

- 1 Reviews

- 4 Students Enrolled

Requirements

- None

General Overview

Description

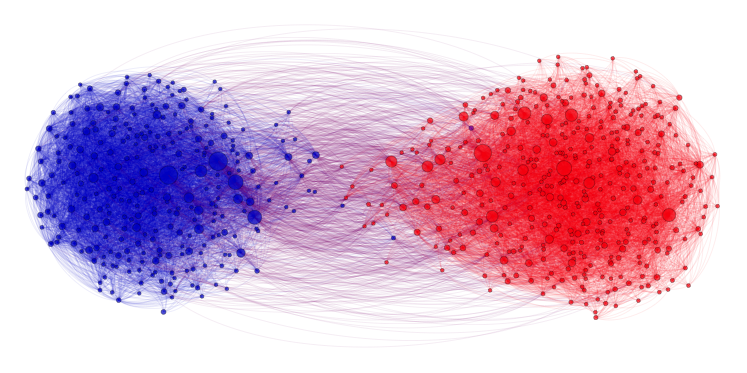

This paper studies heterogeneous network structures driven by different degrees of persistence in economic connections. Using frequency domain techniques, we introduce measures that characterize network connections stemming from transitory and persistent components of shocks. Our approach permits testing for statistical differences in such connections that evolve over time. We estimate uncertainty networks from the main US sectors and argue that they track transitory and persistent sources of systemic risk. Hence they may serve as a useful tool for macro-prudential supervisors and investors alike.

Recommended for you

Meet the instructors !

Jozef Baruník is an Associate Professor at the Institute of Economic Studies, Charles University in Prague. He also serves as a head of the Econometrics department at the Czech Academy of Sciences. In his research, he develops mathematical models for understanding financial problems (such as measuring and managing financial risk), develops statistical methods and analyzes financial data. Especially, he is interested in asset pricing, high-frequency data, financial econometrics, machine learning, high-dimensional financial data sets (big data), and frequency domain econometrics (cyclical properties and behavior of economic variables).

Jozef’s work has appeared in the Review of Economics and Statistics, Econometrics Journal, Journal of Financial Econometrics, Journal of Financial Markets, Econometric Reviews, Journal of Economic Dynamics and Control, The Energy Journal, he is an Associate Editor of the Digital Finance, Journal of Economic Interaction and Coordination, and Kybernetika, and also referees frequently for several journals and grant agencies in the fields of econometrics, finance, and statistics.