代 DAI Digital Art Index

-

- 3.8 Rating

- 2 Reviews

- 49 Students Enrolled

代 DAI Digital Art Index

NFT Art market index

-

- 3.8 Rating

- 2 Reviews

- 49 Students Enrolled

Requirements

- Python, web-scraping

General Overview

Description

The big bang of non-fungible tokens (NFTs) has caused the birth of a brand new era for digital art. NFTs, driven by blockchain and smart contracts, provide both artists and art collectors an unprecedented marketplace which is equipped with more security, flexibility, publicity, and freedom to monetize.

Unlike the conventional art market, NFT art market trades artworks in rapid succession and has no sluggish business cycle. Yet, the emergence of such a market has been considered to be packed with speculation and economic uncertainty, given the limited understanding toward this market.

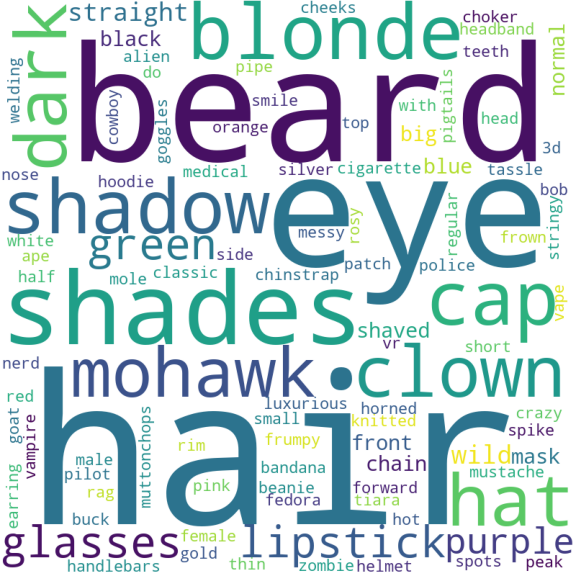

To precisely depict the NFT art market and offer a gauge for market volatility, we construct the price index --Digital Art Index (DAI)-- using a hedonic regression model on the top 10 liquid NFT art collections. In consideration of each artwork's time-variant and time-invariant characteristics, we are able to investigate price determinants and access the intrinsic value of the market.

Courses that include this CL

Recommended for you

Meet the instructors !

Research Interest

- Risk Models

- Machine Learning

- Text Mining

- NFTs, blockchain, Crypto Currencies

Publications

K-expectile clustering (with Wolfgang Karl Härdle and Yingxing Li)

Tail Event Driven Factor Augmented Dynamic Model (with Weining Wang)

Work in Progress

The DAI - Digital Art Index (with Min-Bin Lin, Wolfgang Karl Härdle, Christian Hafner, Artnet)

Understanding NFTs (with Min-Bin Lin, Bruno Spilak)

VizTech & CryptoPunks (with Min-Bin Lin, Wolfgang Karl Härdle)

Min-Bin Lin is currently a PhD researcher at the International Research Training Group (IRTG) 1792 “High Dimensional Nonstationary Time Series” and Blockchain Research Center (BRC) of the Humboldt-Universität zu Berlin. Previously he worked as a research assistant at Kühne Logistics University (Hamburg) and National Tsing Hua University (Taiwan), respectively. His research interests center on blockchain technology and its analytics aiming to contribute towards a better understanding of blockchain technology from dynamical, statistical, and economic perspectives and further solve the problems discovered in the blockchain ecosystem.