Financial Risk Meter (FRM) based on Expectiles

-

- 5 Rating

- 2 Reviews

- 80 Students Enrolled

Financial Risk Meter (FRM) based on Expectiles

A systemic risk management tool

-

- 5 Rating

- 2 Reviews

- 80 Students Enrolled

Requirements

- Interest in risk analysis

General Overview

Description

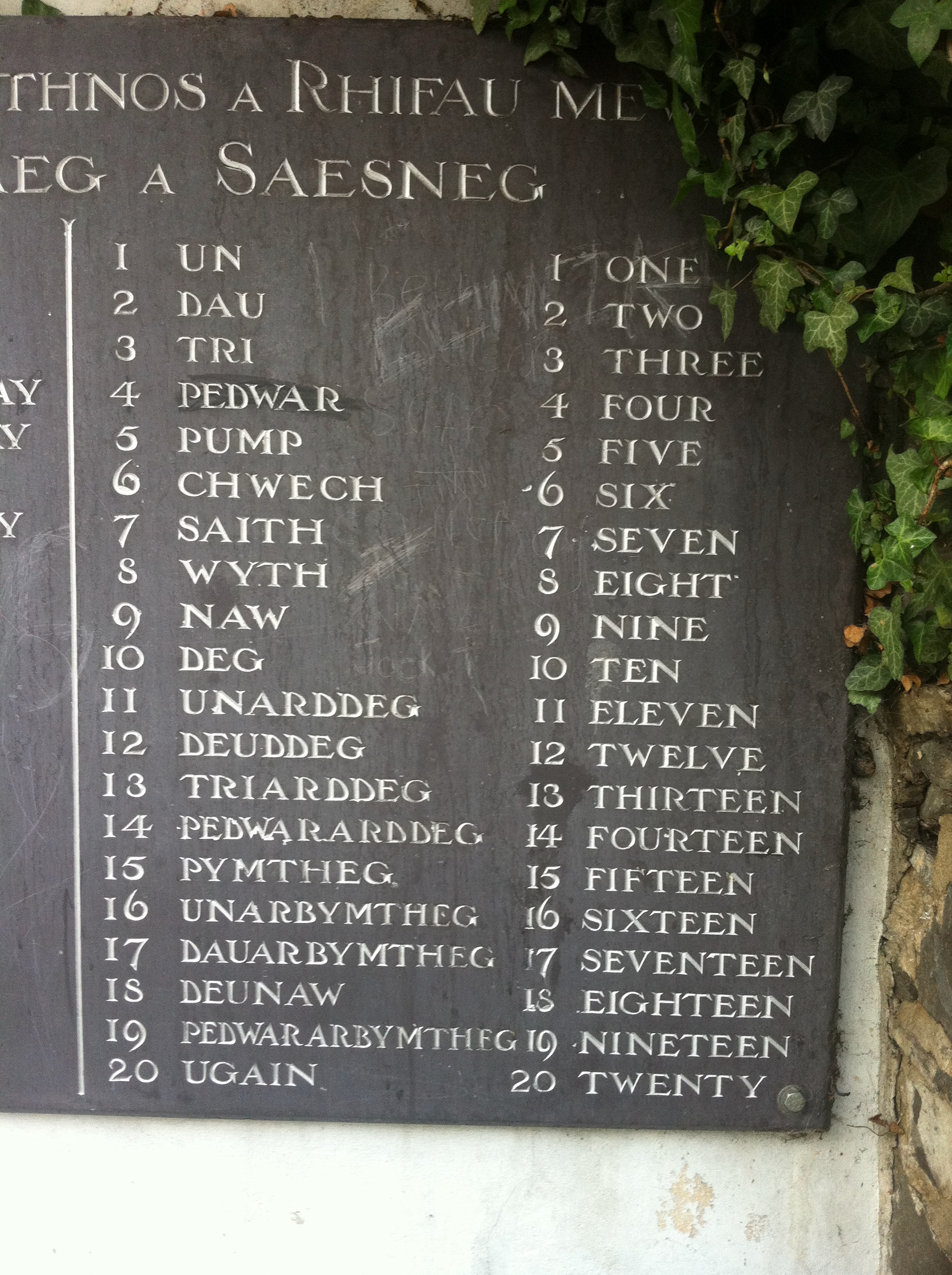

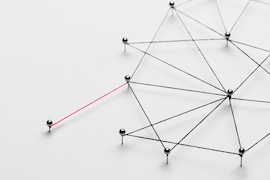

The Financial Risk Meter (FRM) is an established quantitative tool that, based on conditional Value at Risk (VaR) ideas, yields insight into the dynamics of network risk. Originally, the FRM has been composed via Lasso based quantile regression, but we here extend it by incorporating the idea of expectiles, thus indicating not only the tail probability but rather the actual tail loss given a stress situation in the network. The expectile variant of the FRM enjoys several advantages: Firstly, the coherent and multivariate tail risk indicator conditional expectile-based VaR (CoEVaR) can be derived, which is sensitive to the magnitude of extreme losses. Next, FRM index is not restricted to an index compared to the quantile based FRM mechanisms, but can be expanded to a set of systemic tail risk indicators, which provide investors with numerous tools in terms of diverse risk preferences. The power of FRM also lies in displaying FRM distribution across various entities every day. Two distinct patterns can be discovered under high stress and during stable periods from the empirical results in the United States stock market. Furthermore, the framework is able to identify individual risk characteristics and capture spillover effects in a network.